With improving margins, major brand partnerships, and global expansion plans, Tonies is well-positioned for sustained growth. Under CEO Tobias Wann, the company has the potential to become a leader in children’s entertainment and a compelling long-term investment. Here are key questions inspired by Richer, Wiser, Happier to evaluate whether Tonies is a strong investment.

Does the company add value to its customers?

Yes. Tonies provides innovative, screen-free audio entertainment for children. The Toniebox system and its figurines meet the growing demand for engaging and educational screen-free alternatives. The company’s Net Promoter Score (NPS) of over 70 reflects exceptional customer satisfaction and loyalty, validating its value proposition.

Does management provide value to the company?

Yes, Tonies’ management has demonstrated value creation through strategic decisions, operational efficiency, and innovation. Key milestones include achieving positive EBITDA in 2023. The leadership team, strengthened by experienced executives like CFO Dr. Jan Middelhoff and CXO Ginny McCormick, highlights the company’s focus on sustained growth.

Does the company provide value to its shareholders?

Yes. Tonies is steadily creating long-term value for shareholders. Revenue and gross profit have grown consistently, margins are improving, and the company is on track to achieve positive free cash flow by 2024. Partnerships with major brands like Disney and Paramount, combined with global expansion, highlight significant growth potential.

Where will the company be in 10 years?

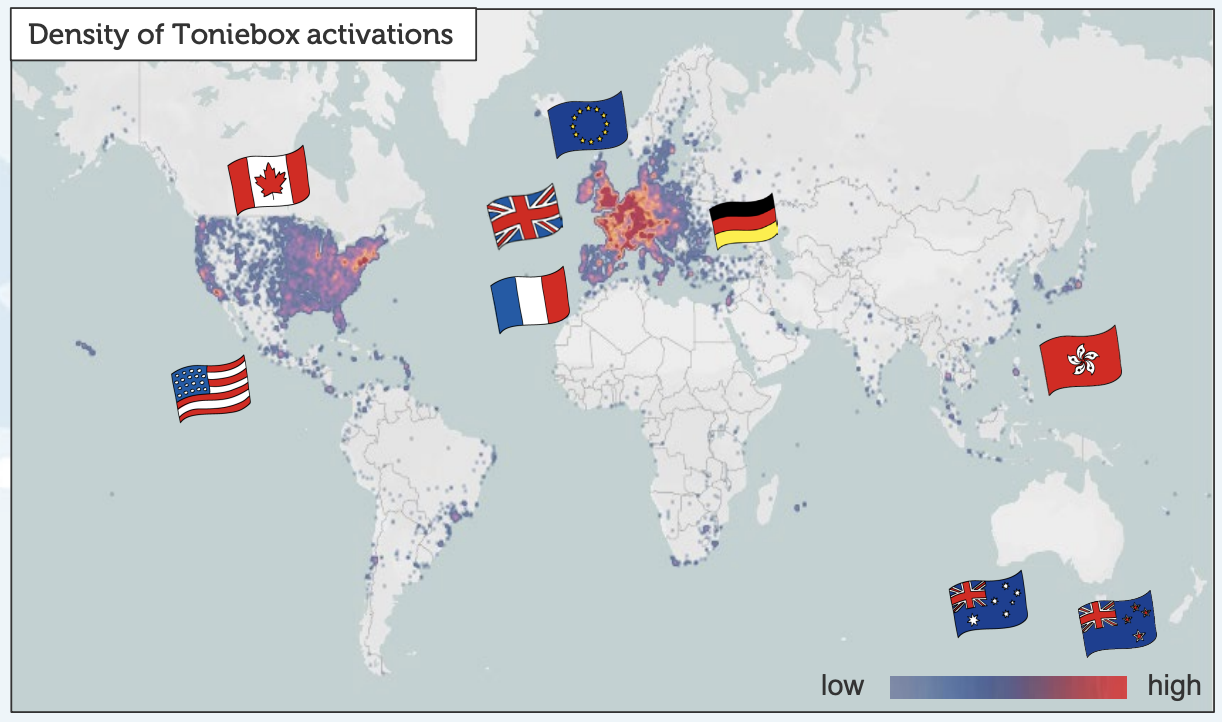

In 10 years, Tonies could emerge as a global leader in children’s screen-free entertainment, with a diversified product portfolio and a presence in emerging markets. The company is well-positioned to sustain growth, expand its ecosystem, and deliver consistent profitability.

I can see Tonies expanding into every classroom and consistently releasing compelling content for years to come. While the technology may be replicable, it’s the partnerships, brand, and content that give them a lasting competitive advantage. I view the company as the Netflix or Spotify for kids.

Are you comfortable with the product and market?

Yes, I personally own a Toniebox for my son, who uses it daily with his 9 figurines. Friends and family also love the product, which was a popular gift this past Christmas. The Toniebox satisfies the demand for screen-free, educational entertainment, solidifying its position in a competitive market.

Are you comfortable with the management?

Yes, the leadership team at Tonies showcases strong strategic foresight and operational expertise. Their focus on profitability, global expansion, and fostering innovation reflects effective management. What’s particularly impressive is their methodical, calculated approach, ensuring they don’t overextend themselves. They consistently excel at controlling costs and managing inventory efficiently.

Would you be happy to leave your money with these managers for 10 years?

Yes, assuming the company continues its current trajectory of revenue growth, profitability, and innovation. The management team’s ability to execute and adapt inspires confidence in their long-term strategy.

Is it a great business with a competent CEO?

Yes, Tonies operates in a niche market with significant growth potential. The product offers a clear value proposition, and with the new CEO, Tobias Wann, at the helm, the company seems poised to build on the founders’ vision, focusing on global scalability and profitability.

Final Assessment

Tonies showcases strong fundamentals, promising growth prospects, and capable leadership. While challenges like competition and a product-specific portfolio remain, the company’s focus on innovation, customer satisfaction, and financial discipline positions it as a solid investment for long-term growth.